The Indian Money Market: Why 2024 Looks Like a Danger Zone Based on 16-Year Cycles

Now The Indian money market in danger zone, particularly its share market, has long been regarded as a vital indicator of the country’s economic health and investor sentiment. As of 2024, a growing chorus of experts and investors is raising concerns that the market is entering what they call a “Danger Zone.” These warnings come not just from short-term volatility but from a deeper historical perspective that highlights a recurring 16-year cycle of major market crises in India.

To understand why 2024 is considered critical, it is essential to examine key episodes from 1992 and 2008, and how similar patterns and economic conditions seem to be converging once again. This article explores the emotional, domestic, and international causes behind these market downturns, offering an insightful look into the past and what it means for the future.

Understanding the 16-Year Market Cycle: A Historical Perspective

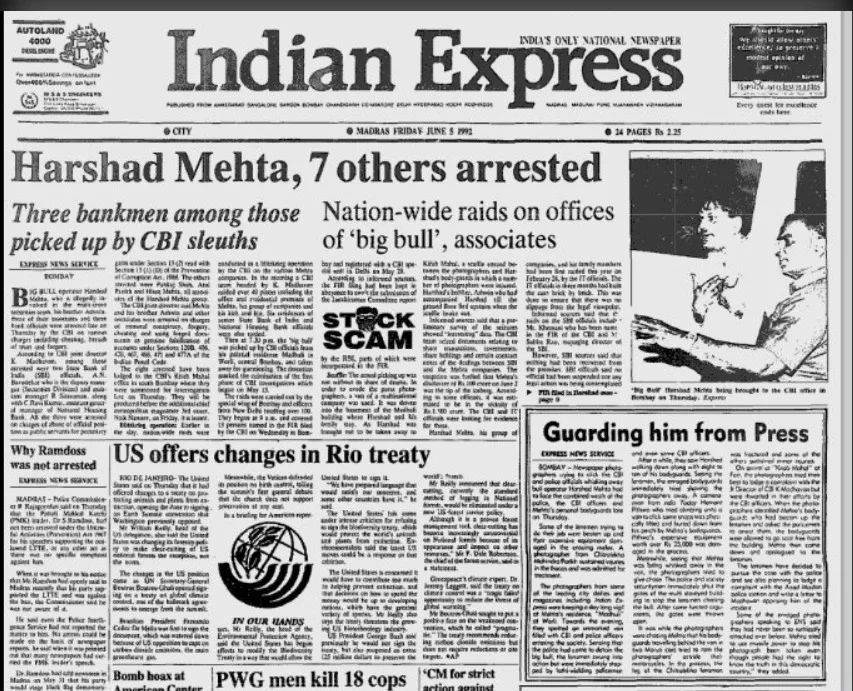

The 1992 Market Crash: The Harshad Mehta Scam Shakes Confidence

On April 28, 1992, the Bombay Stock Exchange (BSE) suffered one of its most significant one-day falls in history—a drop of 12.77%. This dramatic decline followed the unravelling of the notorious Harshad Mehta scam, where fraudulent bank receipts were manipulated to create artificial stock market inflation.

The scam not only devastated investors but also exposed serious loopholes in India’s financial system. At that time, the equity market was still emerging; only about 1-2% of India’s population participated in trading. Despite this limited participation, the market had garnered massive public attention fueled by speculation and rising asset prices. The crash wiped out millions in investor wealth and took years for market confidence to recover fully.

The 2008 Global Financial Crisis and Its Ripple Effect in India

Exactly 16 years later, in 2008, the Indian stock market faced another severe shock. On January 21, 2008, the BSE Sensex plunged by 1,408 points, reflecting global financial turmoil triggered by the collapse of Lehman Brothers in the United States. The financial crisis sent shockwaves worldwide, culminating in a global recession. Indian investors collectively lost nearly Rs 17,605 crore during this downturn.

Adding to the pressure, the year 2008 witnessed the highly publicized IPO of Reliance Power. The issue was oversubscribed by over 73 times, exemplifying speculative frenzy amid a shaky market. While the IPO initially boosted investor enthusiasm, the broader economic uncertainties — including tightening liquidity, rising unemployment, and higher interest rates — soon cast a shadow over the markets.

2024: The Emerging Warning Signs for Money Market is in Danger

Fast forward 16 years, and similar stress points are becoming evident in 2024:

The upcoming HMIL IPO, worth ₹25,000 crore, is anticipated to be massively oversubscribed, hinting at speculative excess.

Inflation, particularly food inflation, remains stubbornly high, putting pressure on household budgets.

Rising unemployment and a banking sector grappling with increasing unsecured loans and a higher debt-to-GDP ratio are sources of concern.

Indian Government Bonds are set for inclusion in the JP Morgan Emerging Markets Bond Index from June 2024, which, while attracting foreign capital, may introduce increased market volatility.

Global financial instability continues, with notable collapses and distress in American banks such as Republic First Bank, Citizens Bank, and Silicon Valley Bank.

The market is currently buoyed by heavy investments from high-net-worth individuals, which may be masking underlying vulnerabilities.

Emotional Causes: How Investor Psychology Has Driven Market Cycles

Market movements are not just dictated by numbers but are deeply influenced by the emotions of market participants. The cycles of 1992, 2008, and 2024 show recurring patterns of investor sentiment.

1992: The Mix of Euphoria and Fear for Money Market is in Danger

During the early 1990s, rapid market gains created a sense of euphoria, enticing investors to pour money into stocks without fully understanding the risks. The exposure of the Harshad Mehta scam abruptly shattered this optimism, triggering panic and a widespread sell-off. Fear replaced greed overnight, causing a sharp market fall.

2008: Panic and Loss of Confidence

The 2008 global crisis introduced panic on an unprecedented scale. Lehman Brothers’ bankruptcy sent shockwaves across financial markets. Investors worldwide scrambled to sell risky assets, and foreign institutional investors exited emerging markets like India in large numbers, exacerbating the market fall.

2024: A Complex Blend of Greed, Speculation, and Fear

Currently, the market environment is marked by extreme speculation, as evidenced by highly oversubscribed IPOs and soaring valuations. Yet, beneath this apparent optimism, fears related to inflation, banking instability, and a looming global recession create a volatile mix. This emotional tug-of-war suggests the market could face significant corrections if underlying issues intensify.

International Causes: Global Financial Shocks Every 16 Years

India’s market is not isolated; international economic developments have historically triggered or intensified domestic market crises.

1992: The Sterling Crisis and Black Wednesday

The UK’s financial crisis on September 16, 1992, known as Black Wednesday, saw the British government withdraw the pound sterling from the European Exchange Rate Mechanism (ERM). This currency crisis impacted global financial markets and diminished investor confidence worldwide, including in emerging economies like India.

2008: Lehman Brothers and the Great Recession

The collapse of Lehman Brothers under a $613 billion debt load was the epicenter of the 2008 financial crisis. This event triggered a global recession that caused massive stock market falls, widespread bailouts, and credit crunches across developed and emerging markets alike.

2024: A New Global Recession and Bank Failures

The year 2024 is witnessing a potential new global recession. The failure of significant U.S. banks, persistent inflation, and economic slowdown threaten global financial stability. Such international shocks directly affect Indian markets through capital flow volatility and investor sentiment.

Domestic Causes: India’s Internal Challenges in Each Cycle

1992: Weak Regulation and Market Manipulation

The 1992 crisis underscored the risks of weak regulatory oversight. Manipulation of bank funds and market securities by unscrupulous players went unchecked, resulting in a massive breach of investor trust.

2008: Liquidity Crunch and Economic Slowdown

While the crisis began overseas, India suffered domestically due to restricted liquidity, higher interest rates, and rising unemployment. The banking sector struggled, and investors retreated from risky assets.

2024: Inflation, Debt, and Overvalued Markets

The present market is challenged by:

Persistent inflationary pressures affecting consumption and corporate profits.

Rising unsecured loans and increasing levels of non-performing assets in the banking sector.

High interest rates limiting borrowing and investment.

A stock market with valuations that seem disconnected from underlying economic realities.

Heavy influence of wealthy investors artificially supporting market prices.

This combination creates a fragile ecosystem vulnerable to shocks.

IPOs: Catalysts of Speculative Cycles

Initial Public Offerings (IPOs) have historically been focal points for speculative bubbles.

In 1992, IPOs were smaller but part of an emerging market enthusiasm.

In 2008, Reliance Power’s IPO was emblematic of excessive market speculation.

In 2024, the mammoth HMIL IPO is drawing intense investor interest, possibly inflating valuations further.

While IPOs offer growth opportunities, excessive speculation can magnify market volatility and expose retail investors to disproportionate risks.

The JP Morgan Emerging Markets Bond Index Inclusion: Double-Edged Sword

India’s government bonds are set to be included in the JP Morgan Emerging Markets Bond Index, starting June 2024. This development is a positive sign, indicating increased global investor confidence and potential capital inflows.

However, inclusion also exposes Indian markets to global investor sentiment swings. Sudden capital outflows due to geopolitical or economic concerns could exacerbate market volatility, making risk management even more crucial and Now the Indian Money Market is in Danger.

Key Takeaways for Investors: Navigating 2024’s Danger Zone

History Offers Lessons, Not Certainties: The 16-year cycle points to patterns but not guaranteed outcomes. Awareness and preparedness are vital.

Avoid Speculative Traps: IPOs and soaring valuations may appear attractive but carry risks, especially in overheated markets.

Watch Global Economic Indicators: Global recessions and financial crises have direct consequences on Indian markets.

Monitor Domestic Economic Health: Inflation, employment, banking sector health, and debt levels should guide investment decisions.

Diversify and Exercise Prudence: Spread risk across asset classes, maintain liquidity, and avoid emotional investment decisions.

Conclusion: Is 2024 a Money Market is in Danger Zone?

The signs are clear. Many indicators in 2024 echo the conditions preceding past crises:

Recurring 16-year cycles of crashes linked to fraud, global shocks, and economic vulnerabilities.

Emotional extremes of greed and fear driving market surges and plunges.

Domestic economic pressures combined with uncertain global conditions.

Overvalued markets propped by select investors and speculative IPO mania.

While timing a market crash is impossible, investors should remain vigilant, prioritize risk management, and avoid speculative excess. Now the Indian Money Market is in Danger

FAQs

Q1: What caused the 1992 and 2008 crashes?

1992’s crash stemmed from the Harshad Mehta scam involving fraudulent securities. The 2008 crash was caused by the global financial crisis triggered by Lehman Brothers’ bankruptcy.

Q2: Why is 2024 risky for the Indian stock market?

Because of high inflation, banking instability, speculative IPOs, a looming global recession, and a market environment reminiscent of past crisis periods.

Q3: Should I invest in large IPOs like HMIL in 2024?

IPO investments carry risks during volatile periods. Conduct thorough research and avoid overexposure.

Q4: How to protect investments during market uncertainty?

Diversify, invest in safer assets, maintain liquidity, and avoid panic selling.