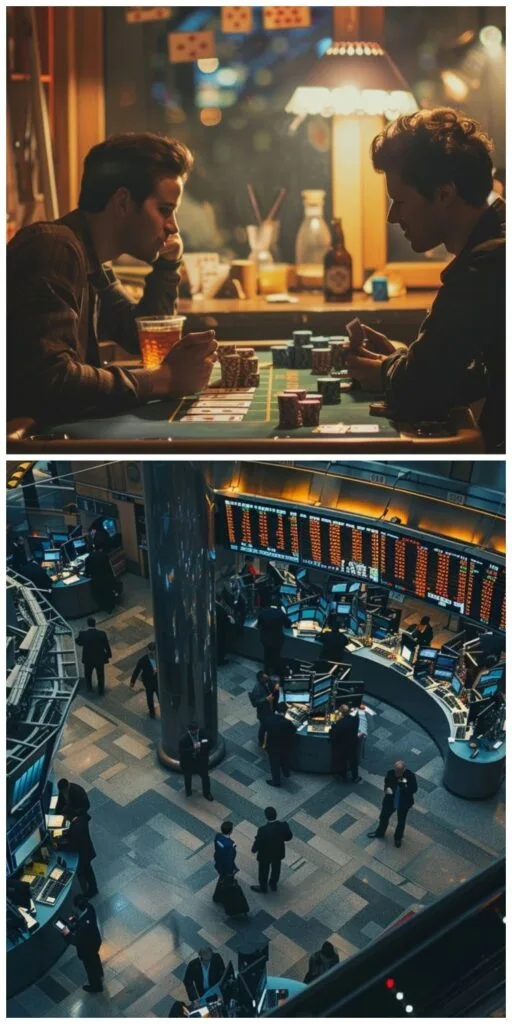

Trading: A Business, Not Gambling

Trading Not a Gambling it’s a Business. The comparison between trading and gambling has been a contentious topic in financial circles for decades. While both involve risk, the critical difference lies in the trader’s approach.

This article delves into how trading can be structured as a legitimate business, and the pitfalls that lead many to mistake it for gambling.

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” —Benjamin Graham.

Trading Not a Gambling it’s a Business

Understanding the Misconceptions: Trading vs. Gambling

When Does Trading Become a Business?

Trading transitions from gambling to business when approached with a disciplined, methodical framework. A trader operating as a business professional evaluates every aspect of the trade—from potential profits and losses to external risks and stress factors.

Key Principles of Business-Oriented Trading

Strategic Planning: • A well-structured trading plan includes specific entry and exit criteria, capital allocation rules, and risk management strategies. For instance, a day trader might decide to only trade stocks with a certain volume and price range, using predefined technical indicators for decision-making.

Risk Management: • Professional traders focus on preserving capital. Tools like stop-loss orders, position sizing, and diversification help control losses. For example, allocating no more than 2% of total capital to a single trade limits exposure to catastrophic losses.

Continuous Improvement: • Markets evolve, and so should strategies. Reviewing past trades, identifying mistakes, and adapting to new trends are hallmarks of successful traders.

Record Keeping: • Detailed records of trades allow for analysis and refinement. Keeping track of wins, losses, and strategies provides insights into what works and what doesn’t.

Professional Mindset: A trader’s mindset can make or break their career. Viewing trading as a business requires emotional resilience, critical thinking, and an unwavering commitment to improvement.

Segments of the Market

The financial markets offer various trading opportunities, each with unique characteristics and risk profiles. Here’s an overview:

1. Equity Markets:

Trading shares of companies is among the most accessible forms of trading. The risks are relatively moderate, as equities represent ownership in a tangible entity with financial records. • Example: An investor buys Apple stock after analyzing quarterly earnings, expecting growth.

2. Commodities:

Commodities like gold, oil, and wheat are traded on dedicated exchanges. These markets are influenced by supply-demand dynamics and geopolitical events, making them more volatile. • Example: A trader might buy crude oil futures, anticipating price increases due to an OPEC production cut.

3. Derivatives:

Options and futures derive their value from underlying assets. These instruments allow for leverage, amplifying both potential profits and losses. • Example: A trader sells put options on Tesla stock, earning premiums but accepting the risk of assignment if the stock price falls.

4. Currency Markets:

Forex trading involves the buying and selling of currency pairs. It is highly liquid but also highly leveraged, posing significant risks. • Example: A forex trader goes long on EUR/USD based on expectations of ECB policy changes.

5. Cryptocurrency Markets:

Cryptocurrencies like Bitcoin and Ethereum are decentralized digital assets traded on global exchanges. These markets operate 24/7, making them attractive but also extremely volatile. • Example: A trader buys Ethereum in anticipation of a major network upgrade increasing its utility and demand.

While equities are generally less risky, other segments require specialized knowledge and strategies to navigate effectively.

The Importance of Balancing Risk and Reward

Successful traders understand that risk is inherent but manageable. The following practices help balance potential rewards against risks:

Risk-to-Reward Ratio: Define acceptable levels of risk for each trade relative to potential rewards. For example, a 1:3 risk-to-reward ratio means risking $100 to gain $300.

Position Sizing: Allocate capital based on risk tolerance. For instance, limiting each trade to 1% of total capital ensures survivability during losing streaks.

Diversification: Avoid concentrating all investments in one asset or sector. Diversification reduces exposure to sector-specific downturns.

Mental Discipline: Staying disciplined in the face of market volatility is critical. Traders must resist the temptation to “chase losses” or “double down” on losing trades.

Scenario Analysis: Evaluating potential outcomes under different market conditions ensures better preparedness and informed decision-making.

Real-World Examples of Trading as a Business

To illustrate, let’s compare two traders—one treating trading as gambling, the other as a business:

Trader A (Gambler):

• Trades randomly based on tips from social media. • Does not use stop-loss orders. • Places large bets, hoping for quick gains. • Ignores market news and trends. • Result: Frequent losses erode capital, leading to frustration and eventual exit from the market.

Trader B (Business Professional):

• Analyzes technical charts and economic data before entering trades. • Implements strict risk management. • Keeps a trading journal to analyze performance. • Continuously updates strategies based on market conditions. • Result: Steady growth in capital, with manageable losses and improved skill over time.

The Psychological Aspects of Trading

Emotional intelligence is a cornerstone of successful trading. The ability to remain calm under pressure, make rational decisions, and maintain confidence through challenges separates top traders from the rest.

Common Emotional Traps:

• Overtrading: Entering too many trades due to excitement or desperation. • Revenge Trading: Trying to recover losses quickly, often leading to further losses. • Paralysis by Analysis: Overanalyzing data and missing opportunities.

Building Emotional Resilience:

• Practice mindfulness techniques to reduce stress. • Develop a routine to analyze trades objectively. • Focus on the process, not just the outcome.

Trading as a Sustainable Practice

The goal of business-oriented trading is sustainability and consistent growth. Success is not defined by short-term profits but by the ability to adapt and thrive in various market conditions.

Attributes of Successful Traders:

Patience: Waiting for high-probability setups rather than chasing trades.

Adaptability: Adjusting strategies based on new information or changing market dynamics.

Continuous Learning: Staying informed about global events, economic indicators, and technological advancements in trading tools.

Networking: Engaging with other traders to share insights and strategies.

Education: Participating in webinars, courses, and reading materials to expand knowledge.

Conclusion: A Professional Mindset Makes the Difference

Trading is not gambling when approached responsibly. It is a business requiring meticulous planning, disciplined execution, and continuous improvement. Traders who treat the markets with respect and adopt a professional mindset can build a rewarding and sustainable career.

By understanding the nuances of trading, developing sound strategies, and focusing on risk management, anyone can elevate their trading practices from a gamble to a legitimate business. The key lies in preparation, discipline, and the willingness to learn from both successes and failures.

Would you like additional tools or resources to enhance your trading approach? Let’s explore how you can take your trading to the next level.